谨防以太坊节点新骗局:USDT欺诈曝光

- 来自 比特派钱包安卓版

- 04-25, 2024

最近的新闻凸显了加密货币诈骗的一个令人担忧的趋势,这些诈骗通过线下交易瞄准毫无戒心的用户。 该方案利用USDT(Tether)并操...

比特派采用业内领先的安全技术,用户的私钥仅存储在自己的设备上,确保资产的绝对控制权和安全性,免受黑客入侵、平台跑路等风险。

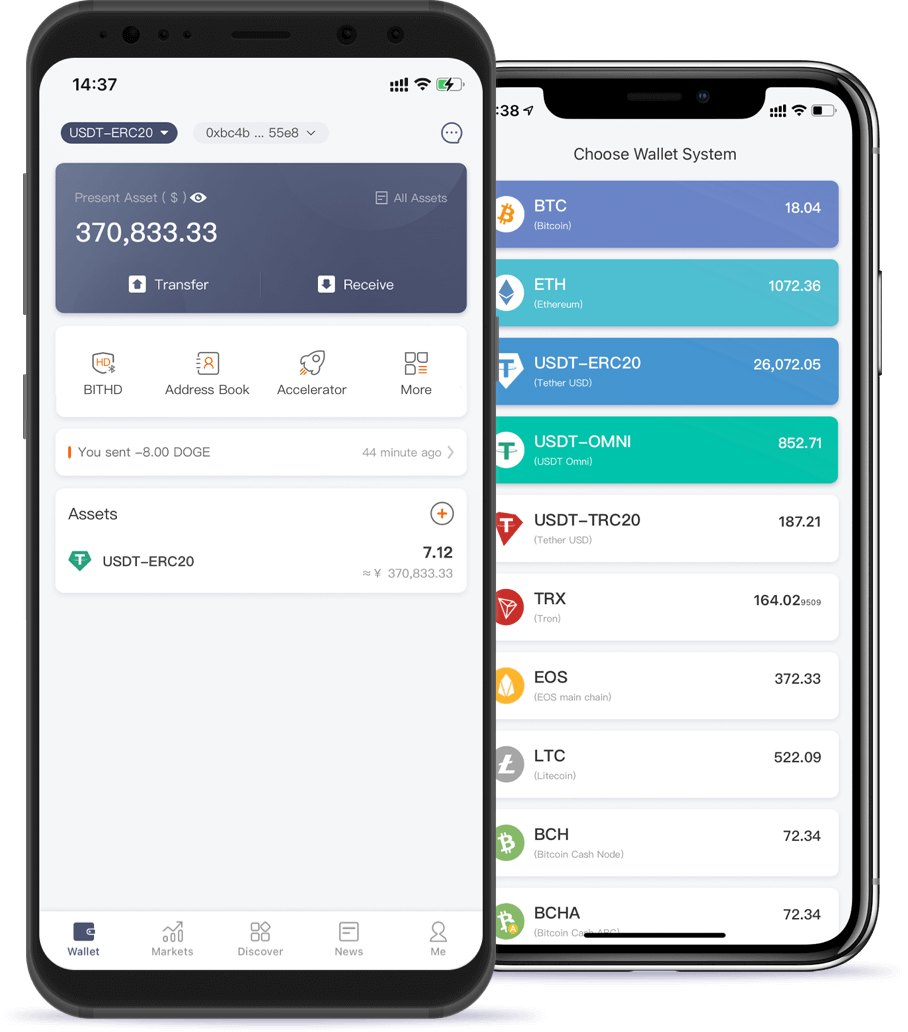

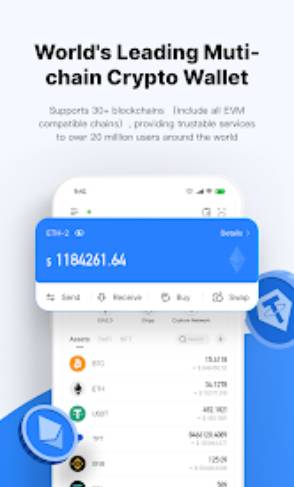

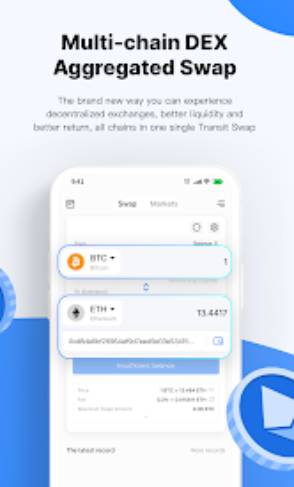

比特派支持BTC、ETH、ERC20等主流公链资产,并对币圈热门项目持续导入,让用户能够在一个钱包内便捷管理不同链上的数字资产。

比特派与ledger等知名硬件钱包完美兼容,用户可将比特派钱包与硬件钱包无缝连接使用,实现资产冷热钱包的无缝切换,最大程度保障资金安全。

轻松访问 BTC、ETH、BNB、TRX、DOT、MATIC、LTC、BCH、ATOM、OP、FIL、ARB、EOS、KSM、XTZ、CKB

比特派钱包搭配硬件钱包,离线签名更安全

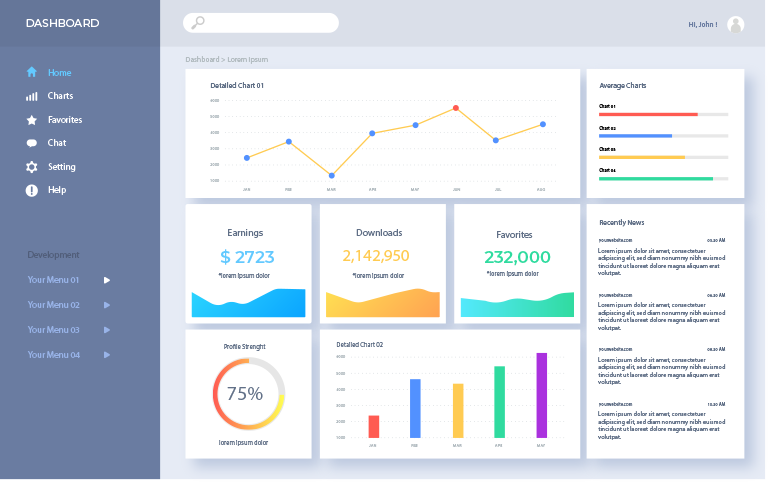

比特派钱包(bitpie)是业内领先的通用加密货币钱包,支持超过200种主流数字货币,包括比特币、以太坊、EOS等。Bitpie钱包安卓/iOS正版App拥有顺畅的操作体验,强大的资产管理功能,并提供专业的行情分析和教育内容。立即前往比特派官网,免费下载Bitpie最新版钱包App,体验安全可靠的加密货币管理!

比特派钱包是我在加密世界中的得力助手!它的多链支持让我能够轻松管理我的各种数字资产,而且DeFi功能也让我能够参与各种有趣的项目。强烈推荐!

作为一个对数字货币投资的新手,我一直觉得钱包的安全性和易用性很重要。比特派满足了我的这两个需求,操作非常简单直观,私钥绝对安全,让我可以放心地管理和使用自己的数字资产。

比特派钱包对于钱包的安全性重视程度很高,采用了很多先进的技术保护用户资金安全,同时也很注重用户体验,界面设计漂亮实用。作为一个老用户,我对比特派钱包的整体表现很满意。

之前我的数字货币资产分散在好几个不同的钱包里,管理起来很不方便。现在有了比特派这款多链钱包,可以将所有资产都集中在这一个钱包里,无缝切换,大大简化了操作,让我重新拥有了对资产的掌控感。

比特派钱包给了我一个便捷的方式来管理我的加密资产。我喜欢它的安全性和多链支持,但有时候在进行交易时会遇到一些费用较高的情况。

比特派钱包的DeFi集成非常方便,但我希望它能够增加更多的教育资源,帮助用户更好地了解和使用DeFi产品和服务。

我从不写评论,但认为这是值得的,已经使用加密货币几个月,并且总是难以购买加密货币并快速获得它这是一个很大的帮助购买了 .5 eth 并且能够在 5 分钟内使用它

比特派钱包(bitpie)是业内领先的通用加密货币钱包,支持超过200种主流数字货币,包括比特币、以太坊、EOS等。Bitpie钱包安卓/iOS正版App拥有顺畅的操作体验,强大的资产管理功能,并提供专业的行情分析和教育内容。立即前往比特派官网,免费下载Bitpie最新版钱包App,体验安全可靠的加密货币管理!

最近的新闻凸显了加密货币诈骗的一个令人担忧的趋势,这些诈骗通过线下交易瞄准毫无戒心的用户。 该方案利用USDT(Tether)并操...

根据毕马威会计师事务所最近发布的一份报告,加拿大的机构投资者去年大幅增加了他们的加密货币敞口。根据毕马威会计师事务所...

在最近的一份报告中,富达数字资产公司透露,持有价值至少 1,000 美元比特币 (BTC) 的比特币地址数量显着增加。在最近的一份报告...

由于 Shiba Inu 的小数点后五位,其 Shibarium区块链已开始大量 SHIB 销毁,可能将其价格推至 0.0001 美元、0.005 美元和 0.01 …...

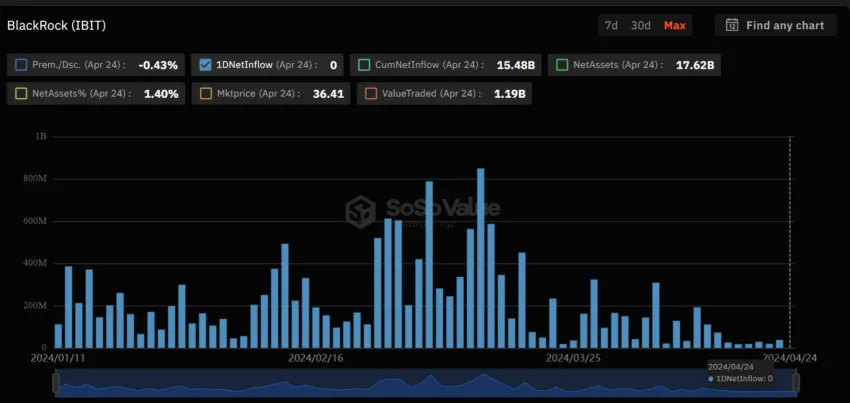

贝莱德 (BlackRock) 的 iShares 比特币信托 (IBIT) 两个多月以来首次没有出现新的资金流入。 这标志着其稳定增长的重大停顿。 这种停滞...